Mega Backdoor Roth: The Supercharged Roth - Next Door

Instead of converting assets from a traditional IRA however it is converting some of the assets from a 401k account into a Roth IRA account. Before deciding if you should take part in the Mega Backdoor Roth IRA Conversion make sure you are already maxing out both your 401k 19000 or 25000 if 50 or older and your Roth IRA 6000 or 7000 if 50 or older.

Mega Backdoor Roth Roth Financial Independence Roth Ira

Mega Backdoor Roth Roth Financial Independence Roth Ira

This strategy allows high-income earners typically not eligible the ability to move money into a Roth IRA account.

Mega backdoor roth: the supercharged roth. This gives savers greater access to Roth contributions than if they relied strictly on direct Roth 401k and IRA contributions. Mega Backdoor Roth IRA Mechanics. Assuming a plan is able to get over the ACP test hurdle here is how the mega backdoor Roth IRA may be accomplished.

Rest assured that despite the shady sounding name a mega backdoor Roth is a perfectly legal and legitimate investment option. Mega backdoor Roth IRAs involve 401k plans. If you are considering a mega-backdoor Roth you first should be maxing out your 401k and IRA contributions.

The Mega Backdoor Roth IRA move takes the idea behind the standard Roth IRA conversion and expands upon it enabling individuals to push much more money into a Roth IRA each year. A Mega Backdoor Roth is a tax loophole that allows high-income earners to put more of their paycheck into a Roth account and reap the benefits of tax-free growth. The mega backdoor Roth leverages on this fact to allow one to convert the non-deductible traditional IRA contribution into a Roth IRA account.

The mega backdoor Roth IRA. Mega-Backdoor Roth Even better you can do a similar thing with your 401K but on a much grander scale. People who have 401k plans through their employeralong with the ability to make after-tax contributions to that plancan roll over up to 37500 in after-tax contributions into a Roth IRA.

Its designed for high-income earners who dont qualify for a traditional Roth IRA. The Mega Backdoor Roth IRA is a great retirement strategy. If you choose to contribute to a Roth IRA or to complete a backdoor Roth IRA conversion you are choosing to be taxed now instead of later.

The resulting maximum mega backdoor Roth IRA contribution for 2021 is 38500 up from 37500 in 2020 if your employer makes no 401k contributions on your behalf. If you are not currently maxing both accounts focus on doing so before even considering this type of a strategy. A mega backdoor Roth individual retirement account IRA is part of the shortcut route.

Advanced planning strategies such as the mega backdoor Roth can have many moving pieces and negative tax implications. A Roth IRA account is a retirement savings account that allows your contributions to grow free of taxes. For a long time it was an unspoken secret used by retirement planners.

But not all 401k plans allow them. You can then convert the extra after-tax savings to Roth dollars tax-free. The annual addition limit for 2021 is 58000.

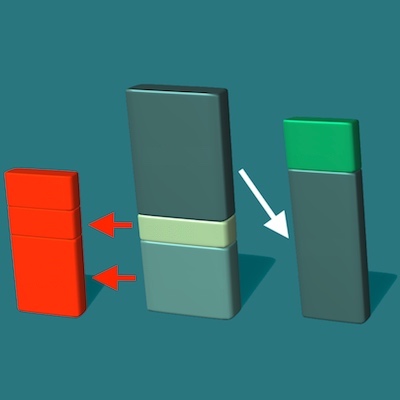

Make after-tax contributions of the desired amount to the qualified plan. However the IRS released guidance that specifically addressed both backdoor Roth IRA conversions and the so-called Mega Backdoor Roth IRAAs a result it has gained even more popularity and interest. A mega backdoor Roth strategy allows employees participating in 401k plans with after-tax contributions to save in a Roth account even if their high income would normally disqualify them from contributing to a Roth IRA.

A mega backdoor Roth takes this even further. Before you read any further if you are not max funding your traditional 401k 19500 if you are under 50 or 25500 if you are over 50 then do that first. It also lets employees save up to 37500 in the Roth 401k account which exceeds the normal 6000 Roth IRA annual limit.

Enter the supercharged savings. That means you might be able to contribute an additional 20000 or more after-tax each year after maxing your elective deferral and receiving your match. A mega backdoor Roth conversion is very different than the standard backdoor Roth IRA conversion.

A mega backdoor Roth offers the opportunity for some investors to contribute up to an extra 37000 for 2019 to a Roth IRA via their employers 401k. The mega backdoor conversion is a different choice. The mega backdoor Roth is a tool that can allow you to put savings into overdrive.

This is a potential strategy if you are looking for ways to optimize your long-term savings strategy and create additional tax diversification. 401K plans vary but most allow you to contribute after-tax contributions above your limit. And even after-tax contributions for the Mega Backdoor Roth.

Missing out on the tax deduction is a downside. The after-tax contributions effectively become Roth IRA contributions. Just make sure the plan allows for them and the proper steps are followed.

But you have. A mega backdoor Roth lets people save as much as 37500 in a Roth IRA or Roth 401k in 2020. In 2020 an employee can contribute up to 19500 to their 401k.

There has been a lot of talk lately about the mega backdoor Roth IRA. Based on IRS Notice 2014-54 retirement plan participants may consider the Mega Backdoor Roth strategy as a means to maximize savings in a tax-free account.

The Greatest Roth Tax Strategy You Never Heard Of Episode 247 Ira Financial Group

The Greatest Roth Tax Strategy You Never Heard Of Episode 247 Ira Financial Group

How To Do Backdoor Roth Ira Roth Ira Roth Ira Contributions Finance

How To Do Backdoor Roth Ira Roth Ira Roth Ira Contributions Finance

What Is A Mega Backdoor Roth And How Does It Work Sofi

What Is A Mega Backdoor Roth And How Does It Work Sofi

Mega Backdoor Roth Solo 401 K This Is What You Need To Know Ira Financial Group

Mega Backdoor Roth Solo 401 K This Is What You Need To Know Ira Financial Group

Backdoor Roth The Roth Nobody Told You About Kinetix Financial Planning

Backdoor Roth The Roth Nobody Told You About Kinetix Financial Planning

Mega Backdoor Roth Explained Merriman

The Mega Backdoor Roth Ira Mom And Dad Money

The Mega Backdoor Roth Ira Mom And Dad Money

Mega Backdoor Roth Park Up To 36 000 Per Year In Roth Ira Attain Fire

Mega Backdoor Roth Park Up To 36 000 Per Year In Roth Ira Attain Fire

The Boring Way To Retire A Millionaire The Tortoise Approach

The Boring Way To Retire A Millionaire The Tortoise Approach

How To Build A Real Estate Crowdfunding Ladder Are You Trying To Create A System That Allows You To Live Off The Cas Crowdfunding Real Estate Funds Real Estate

How To Build A Real Estate Crowdfunding Ladder Are You Trying To Create A System That Allows You To Live Off The Cas Crowdfunding Real Estate Funds Real Estate

A Mega Backdoor Roth For Mega Long Term Wealth

A Mega Backdoor Roth For Mega Long Term Wealth

The Mega Backdoor Roth Solo 401 K For Solopreneurs Alterra Advisors

The Mega Backdoor Roth Solo 401 K For Solopreneurs Alterra Advisors

Understanding The Mega Backdoor Roth Ira Podcast 127 White Coat Investor

Understanding The Mega Backdoor Roth Ira Podcast 127 White Coat Investor

How To Invest Money How To Invest In Stocks Investing In Index Funds Investing Tips Investing In Your 20s Investing Money Investing Investing In Stocks

How To Invest Money How To Invest In Stocks Investing In Index Funds Investing Tips Investing In Your 20s Investing Money Investing Investing In Stocks

Mega Backdoor Roth The Supercharged Roth Kinetix Financial Planning

Mega Backdoor Roth The Supercharged Roth Kinetix Financial Planning

How To Create A Personal Budget In Excel Personal Budget Budgeting Budgeting Tips

How To Create A Personal Budget In Excel Personal Budget Budgeting Budgeting Tips

Budgeting 101 Budgeting For Beginners Budgeting Budgeting 101 Financial Planning Saving Money

Budgeting 101 Budgeting For Beginners Budgeting Budgeting 101 Financial Planning Saving Money

0 Comments